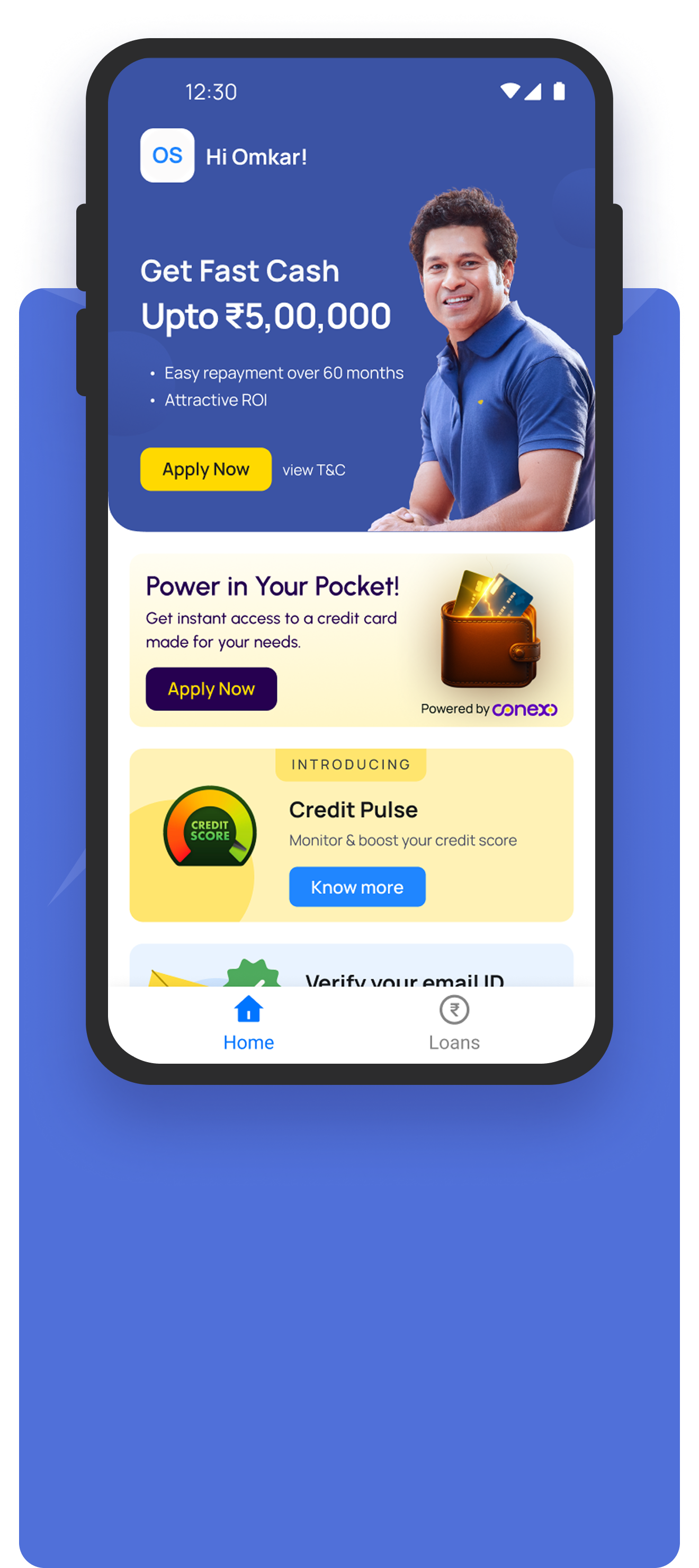

KISSHT - INSTANT PERSONAL LOAN APP

Get instant personal loans and business loans up to ₹5 Lakhs in minutes! Download the Kissht app now

Why Choose Kissht for Personal Loan App?

Instant Approval Process

Apply in minutes through our

instant loan app.

Quick Disbursal

Get cash disbursed to your account within minutes.

100% Digital Journey

No physical paperwork is needed with Kissht online loan app.

Flexible Loan Amounts

Choose small or big loans as needed.

Trusted by Millions

One of the best loan apps in India.

Borrow Anytime

24x7 access through our instant personal loan app.

How to avail Kissht Personal Loan App?

Step 1

Open your phone's Google Playstore app.

Step 1

Open your phone's Google Playstore app.

Step 2

Type “Kissht ” in the search bar.

Step 2

Type “Kissht ” in the search bar.

Step 3

Tap on the official app from Kissht.

Step 3

Tap on the official app from Kissht.

Step 4

Click ‘Install’, then wait for the download to finish

Step 4

Click ‘Install’, then wait for the download to finish

Step 5

Open Kissht app and sign up to explore instant personal loan offers

Step 5

Open Kissht app and sign up to explore instant personal loan offers

Who Can Benefit from Kissht Loans?

Salaried Individuals

If you receive a regular monthly salary, you can easily apply through Kissht’s instant personal loan app.

Self-Employed Professionals

Business owners, consultants, and professionals can avail loans via our trusted online loan app.

Freelancers

Working independently? You're eligible too. Get access to quick funds using Kissht’s loan app.

First-Time Borrowers

New to credit? You can still apply and explore personal loan options with Kissht.

Documents Required for Personal Loan Online

Basic details

Name, address, and employment information to assess personal loan eligibility for salaried individuals.

KYC Documents

Submit Aadhaar card and selfie verification via theinstant loan app.

PAN Card

Required for identity verification while applying for an instant personal loan.

Income details

Proof of income is required to be eligible for an instant loan online.

How Kissht Protects Your Data?

Your data stays safe with Kissht

We follow stringent security protocols and comply with all regulatory standards to keep your information safe.

Safe & Secure

Popular Reasons People Use Kissht

Medical Emergencies

Doctor’s bills don’t wait—your loan shouldn’t either. Get an instant personal loan when you need it most

Education Fees

From coaching fees to semester dues, fund it fast. Kissht’s online loan app gets it done

Shopping or Festive Needs

Splurge smart with a quick loan for that wishlist. Try Kissht for instant personal loans.

Bill Payments & Rent

Beat late fees and never delay rent again. Access loan options anytime, anywhere.

Home or Car Repairs

Fix it now, pay later with flexible EMIs. Use the best loan app in India to stay stress-free.

Frequently Asked Questions?

The Kissht app is one of India’s leading fintech personal loan platforms, helping users access instant personal and business loans through a fast and secure digital process. Applicants can check offers, track EMIs, and manage repayments in one dashboard, making it a trusted choice for simple and transparent lending.

You can download the Kissht app directly from the Google Play Store. Just search for 'Kissht' and tap ‘Install’ to begin. Once downloaded, you can explore instant personal loan and business loan offers through a fully digital process. The app is designed to be quick and user-friendly, making it a trusted choice among popular instant loan app options in India.

Kissht enables quick approval for personal loans for Indian citizens aged 21–60 with PAN and Aadhaar KYC. Salaried employees, self-employed professionals, business owners, and first-time borrowers can apply. Income proof is required only for select loan amounts based on risk assessment and credit history.

Applying for an instant personal loan online with the Kissht app is quick and fully digital:

Step 1: Verify your mobile number via OTP.

Step 2: Fill in basic details like name, DOB, and employment information.

Step 3: Complete KYC by uploading your PAN and Aadhaar Card.

Step 4: Once approved, your loan is instantly credited. Kissht is a reliable instant loan app built for fast, easy access.

To apply for a personal loan with the Kissht app, you’ll need: 1. Basic details – name, address, and employment information 2. KYC documents – Aadhaar card and a live selfie 3. PAN card – for identity verification 4. Income proof – required for select loan amounts

Show More FAQs