Sukanya Samriddhi Yojana: Step by Step Application Process

Planning long-term financial security for a girl child is a priority for many families in India. The Sukanya Samriddhi Yojana, launched under the Beti Bachao Beti Padhao initiative, is one of the most trusted savings schemes designed to support a daughter’s education and future expenses. Understanding the Sukanya Samriddhi Yojana details helps parents build disciplined savings habits from an early stage.

Today, many parents also explore complementary financial tools such as a loan EMI calculator, digital loan apps, or options for instant loan online through platforms like Kissht to manage short-term financial needs while continuing long-term investments like the Sukanya Samriddhi account scheme. These tools help families maintain savings consistency while handling urgent expenses smoothly.

What is Sukanya Samriddhi Yojana?

The Sukanya Samriddhi Yojana scheme is a government-backed small savings programme that allows parents or guardians to open an account for a girl child below the age of 10. Opening a Sukanya Samriddhi Yojana account provides attractive interest returns and tax benefits, making it suitable for long-term planning.

Key Sukanya Samriddhi Yojana Scheme Details

- Account can be opened for a girl child below 10 years

- Deposits can be made for up to 15 years

- Account matures after 21 years from opening

- Partial withdrawal permitted for higher education

These Sukanya Samriddhi Yojana scheme details make it a structured option for future financial planning.

Sukanya Samriddhi Yojana Interest Rate and Returns

One of the major advantages of the Sukanya Samriddhi Yojana is its competitive Sukanya Samriddhi Yojana interest rate, reviewed periodically by the government.

Interest Highlights

- Interest compounded annually

- Higher returns compared to many savings accounts

- Eligible for tax benefits under applicable rules

The Sukanya Samriddhi Yojana interest helps savings grow steadily, supporting long-term goals like education or marriage expenses.

Benefits of Sukanya Samriddhi Yojana

Understanding the benefits of Sukanya Samriddhi Yojana helps families assess its value for long-term savings.

Sukanya Samriddhi Yojana Benefits

- Government-backed security

- Attractive interest returns

- Tax advantages on deposit and maturity

- Encourages disciplined annual savings

These Sukanya Samriddhi Yojana benefits make the scheme dependable for long-term planning.

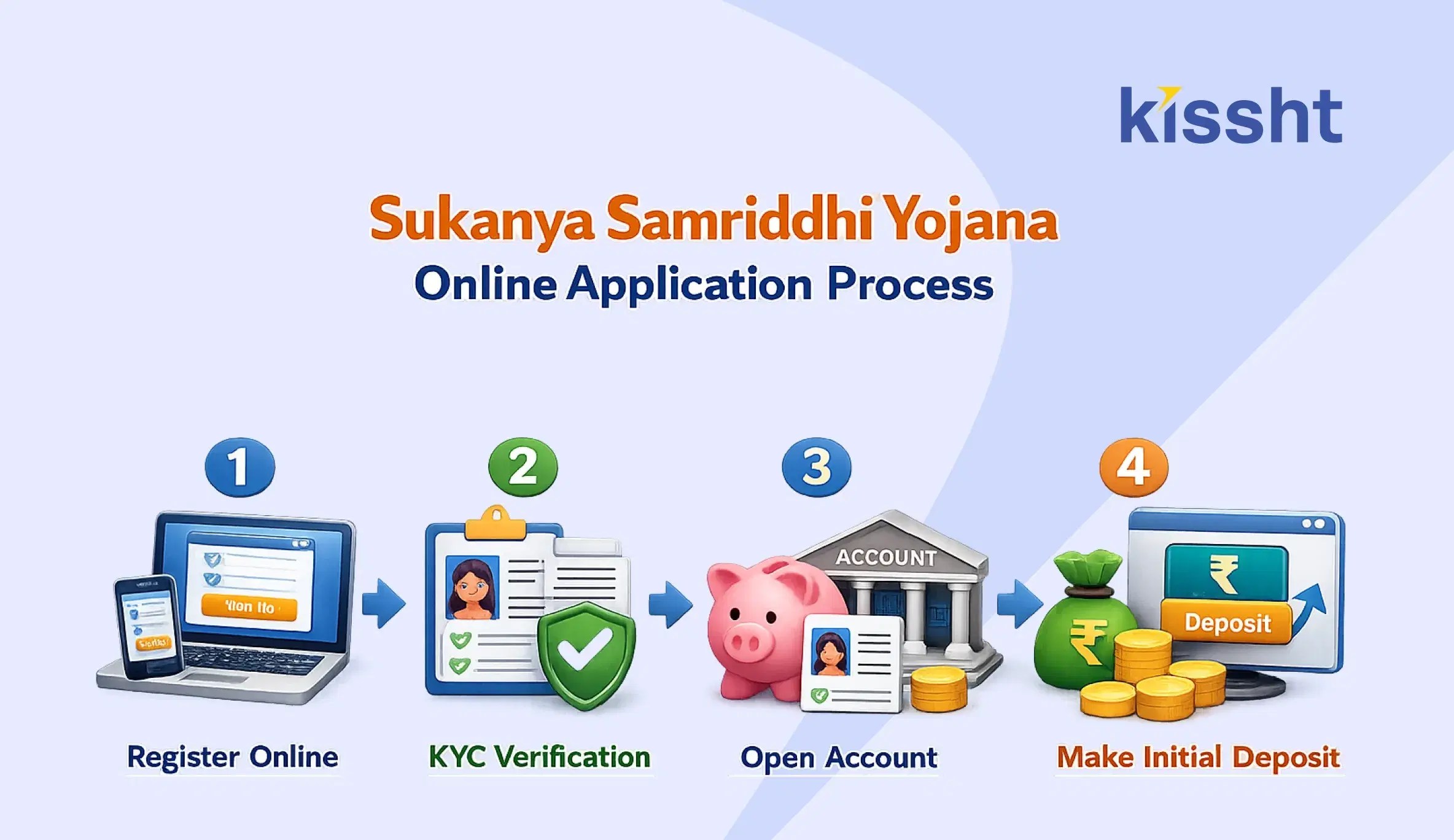

How to Open Sukanya Samriddhi Account Online

Many parents search for how to open Sukanya Samriddhi account online or whether SSY account opening online is possible. While the full process may vary by bank or post office, several steps can be completed digitally.

Steps for Sukanya Samriddhi Account Online Opening

- Visit the bank or post office website supporting Sukanya Samriddhi Yojana online services

- Fill the Sukanya Samriddhi Yojana online apply form

- Upload child details and required documents

- Submit KYC proof of guardian

- Make the first deposit to activate the Sukanya Samriddhi account online

Following these steps simplifies the SSY account opening online process.

How to Apply for Sukanya Samriddhi Yojana

Parents often look for how to apply Sukanya Samriddhi Yojana or how to apply for Sukanya Samriddhi Yojana online to begin saving early.

Application Process

- Collect or download the application form

- Fill guardian and child information accurately

- Submit birth certificate and KYC documents

- Make initial deposit

- Receive confirmation of Sukanya Samriddhi Yojana account activation

These steps explain how to apply for Sukanya Samriddhi Yojana easily through authorised banks or post offices.

Managing Financial Needs Alongside Long-Term Savings

While contributing regularly to the Sukanya Samriddhi Yojana, families may encounter short-term expenses such as school fees, medical bills, or urgent household costs. Using a loan EMI calculator helps estimate repayment schedules and choose borrowing options carefully.

Some families also consider instant loan online solutions through verified loan apps for urgent funding. Trusted platforms like Kissht provide accessible financial support without disrupting contributions to the Sukanya Samriddhi account scheme. Selecting reliable instant loan online options ensures quick access to funds while maintaining responsible repayment planning.

Tips for Maximising Sukanya Samriddhi Savings

- Start contributions early to benefit from compounding

- Deposit consistently every year

- Track Sukanya Samriddhi Yojana interest rate updates

- Maintain proper documentation for withdrawals

- Align savings with future education planning

These practices help maximise long-term benefits from the Sukanya Samriddhi Yojana.

Final Thoughts

The Sukanya Samriddhi Yojana online process has made it easier for families to secure their daughter’s financial future through disciplined savings. With competitive interest returns, government backing, and structured deposits, the scheme remains one of India’s most reliable long-term investment options.

Balancing savings with immediate financial needs is equally important. Using a loan EMI calculator, exploring instant loan online, or accessing support through Kissht when necessary helps families maintain financial stability while continuing their Sukanya Samriddhi savings journey.

FAQs

What is the Sukanya Samriddhi Yojana interest rate?

The Sukanya Samriddhi Yojana interest rate is revised periodically by the government. Parents should check official updates for the latest rate.

Can I complete Sukanya Samriddhi Yojana online apply fully online?

Many banks allow partial Sukanya Samriddhi Yojana online apply steps digitally, though final verification or deposit may require visiting a branch.

How to apply for Sukanya Samriddhi Yojana easily?

You can visit a bank or post office, or follow how to apply for Sukanya Samriddhi Yojana online instructions on the institution’s website.

Instant Loans at Your Fingertips

Personal Loan

Fast, hassle-free loan for your personal needs.

Business Loan

Fuel your business growth with quick approvals.

Loan Against Property

Unlock your property’s value with ease.

Credit Pulse

Boost your credit score with smart insights.

Track your credit score

Simply enter your mobile number to get a quick overview of your credit score.

Check Now

Related articles

Feb 8, 2026

Top Super Bikes in India 2026: Price, Mileage & Performance Comparison

Feb 6, 2026

Top 10 Best Cars Below ₹10 Lakhs in India 2026

Feb 9, 2026

How to File Income Tax IT Return Online: Meaning, Step-by-Step Process

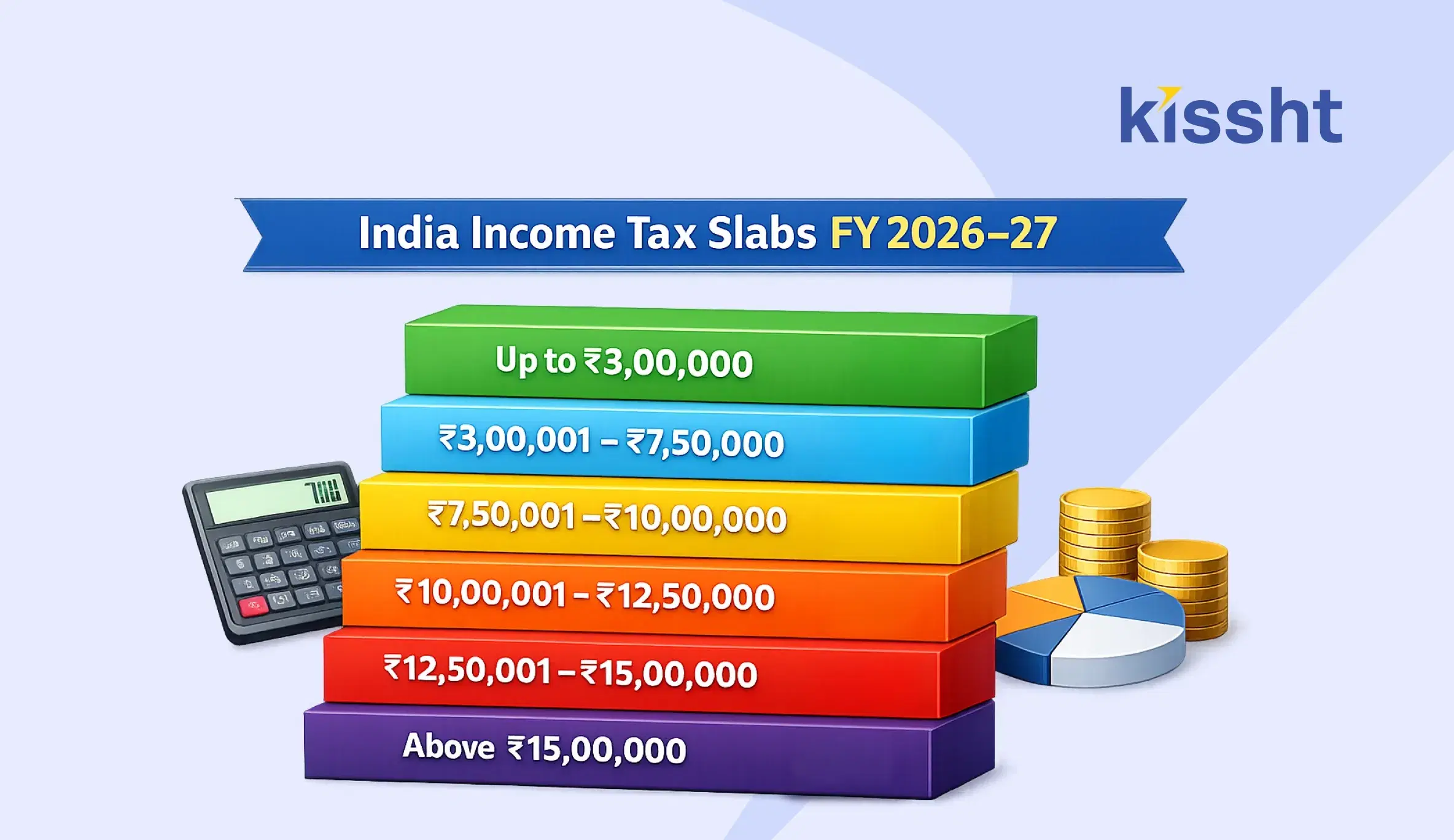

Feb 10, 2026

Income Tax Slab Rates in India for FY 2026-27

Feb 11, 2026

List of Beaches in Goa with Location & Activities - 2026

Feb 2, 2026

Common Financial Mistakes People Make in Their 20s & 30s

Jan 29, 2026

ITR Filing Last Date for AY 2026-27 (FY 2025-26)

Jan 28, 2026

How to File GST Returns Online: Step-by-Step Process for Taxpayers

Feb 02 ,2026

Union Budget India 2026: Smt. Nirmala Sitharaman Budget Highlights

Jan 24, 2026

How to Download Masked Aadhaar Online

Jan 25, 2026

Best AI Courses Online in 2026: Top Artificial Intelligence Certifications

Jan 29, 2026